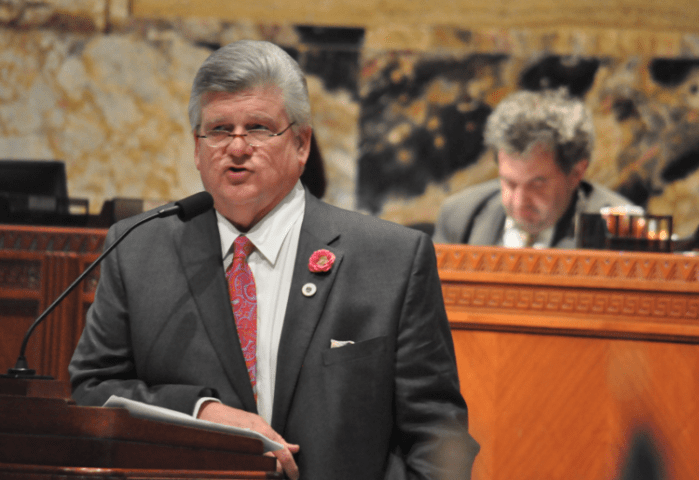

Paul Braun and Drew White

It’s only one-sixth of a penny.

That’s all that divides the House and the Senate over how much of an expiring penny of sales tax to extend.

That extra sixth of a penny would cost Louisiana residents 17 cents on a $100 purchase. If you shop for school supplies for a high school student, it would add 67 cents to the average $392 bill. It would boost the cost of a $1,299 MacBook Pro by $2.21 and add $69.70 to the $41,000 sticker price of a well-equipped Lexus ES sedan.

It also would raise $150 million a year to avert cuts to TOPS, health care, and other services.

Read the story in KALB.