Tryfon Boukouvidis

After several contentious days, the House on Monday passed a Republican bill 76-28 to partially address the impending fiscal cliff when temporary revenue measures expire this summer.

The bill broke a logjam in the House, which could not agree on any revenue measures in March and marked a significant step toward solving some of the state’s budget problems.

The bill now goes to the Senate, which could adjust it to raise more revenue to ease possible cuts in health care and higher education.

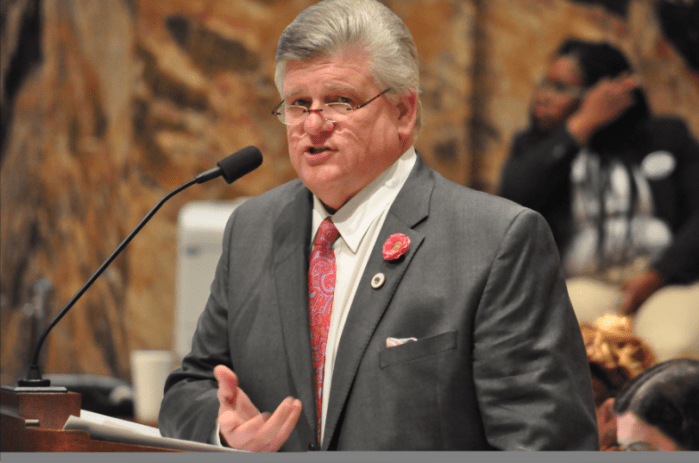

The House bill, authored by Rep. Lance Harris, R-Alexandria, the leader of the Legislature’s Republican delegation, would temporarily extend one-third of a penny of state sales tax. That would raise $369 million in revenue next year, and the third of a penny, which would make the state sales tax. 4.33 percent, would remain in effect through 2023.

Read the story in The Franklin Sun.